Week in Review: U.S.-China Tariff Whiplash Weighs on Demand Outlook and Prices

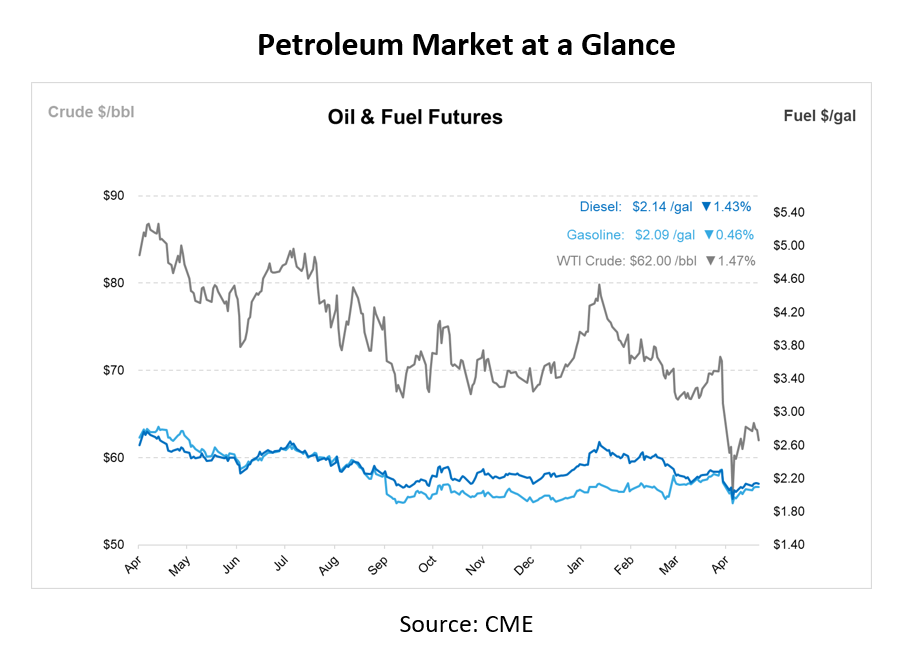

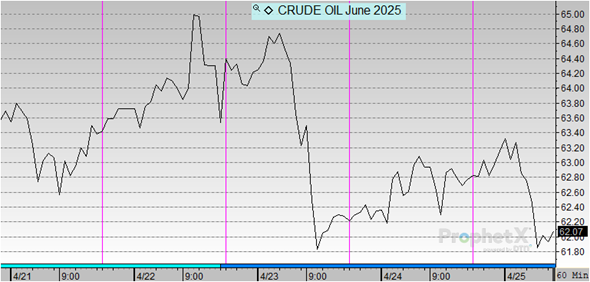

Oil prices were volatile this week thanks to US and China tariff whiplash and OPEC uncertainty. After sliding nearly 2% midweek, WTI crude dropped another $0.79 to $62 per barrel this morning, stoking fresh oversupply concerns and persistent uncertainty surrounding global trade negotiations.

At the heart of the volatility was renewed tension within OPEC+. Kazakhstan, responsible for about 2% of global oil output, indicated it may prioritize domestic production goals over group quotas. This move unleashed fears of fragmentation within the alliance, echoing Angola’s departure from OPEC+ in 2023. Escalating internal disagreements could lead to a breakdown in cohesion and potentially trigger a price war.

Geopolitical risk also took center stage this week as contradictory messages emerged from the U.S. and China regarding the future of tariff negotiations. While President Trump suggested that trade discussions were ongoing and hinted at potential tariff reductions, from the current 145% to a possible range of 50–65%, Chinese officials publicly denied any active talks. Beijing reiterated its demand for full cancellation of all “unilateral” tariffs as a precondition for meaningful negotiations.

China’s call for tariff relief came alongside a roundtable hosted for more than 80 foreign companies concerned about U.S. tariffs’ effects on investment. Chinese officials encouraged firms to adapt and pledged to improve business conditions. A prolonged trade war could cut China’s oil demand growth in 2024 by half, from 180,000 bpd to just 90,000 bpd.

While the U.S. and Iran are scheduled for a third round of nuclear talks this weekend, any optimism was tempered by the U.S. reimposing sanctions on Iran’s energy sector earlier in the week. The move casts doubt on the likelihood of Iranian crude returning to global markets in the near term.

Meanwhile, diplomatic progress in the Russia-Ukraine conflict raised the possibility that sanctions could be eased, potentially allowing more Russian oil to reenter the global supply chain. Combined with speculation that OPEC+ could accelerate production hikes in June, these developments added downward pressure to crude prices.

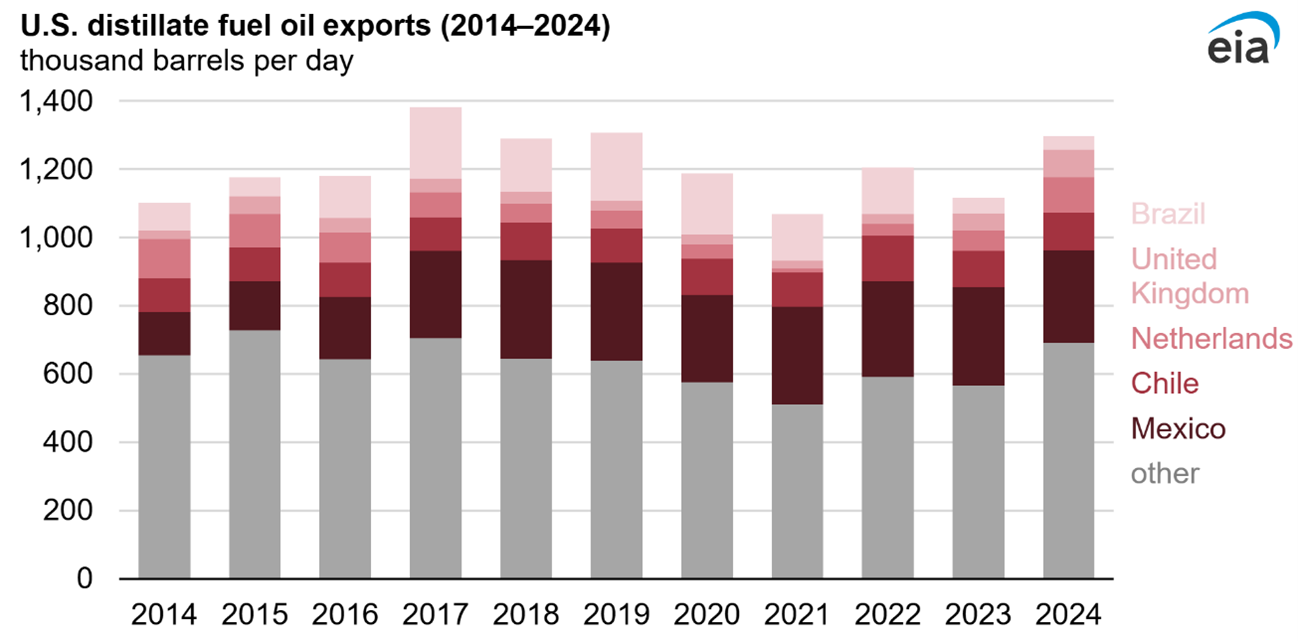

Despite market headwinds, the U.S. reached a new milestone in petroleum exports. In 2024, total exports of petroleum products jumped to a record 6.6 Mbpd, up 495,000 bpd from 2023. The increase was largely driven by diesel and jet fuel, while gasoline exports saw a slight decline.

Diesel exports rose 182,000 bpd to 1.30 Mbpd, with Mexico accounting for 21% of total shipments, followed by Chile, the Netherlands, the UK, and Peru. Jet fuel exports reached 209,000 bpd, led by Mexico at 63,000 bpd. Gasoline exports totaled 877,000 bpd, with Mexico again dominating at more than half of all U.S. outbound volumes. Brazil, once a top U.S. buyer, steeply reduced imports in favor of discounted Russian fuel. In contrast, European countries like the Netherlands and the UK significantly increased their purchases of U.S. distillates following sanctions on Russian imports.

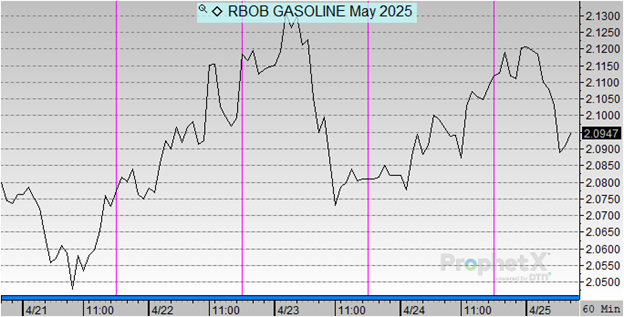

Prices in Review

Crude prices opened the week at $64.30 and experienced modest volatility throughout the week. The sharpest drop came on Thursday, when prices dipped to $62.34. While there was a slight increase on Friday to $62.86, the market remained under bearish sentiment. Overall, crude declined by $1.44 this week, a 2.24% decrease from Monday’s opening price.

Diesel prices opened at $2.1462 on Monday and saw some fluctuation throughout the week. Prices dipped on Tuesday to $2.1201, followed by a midweek jump to $2.1574 on Wednesday. After a slight decline on Thursday, diesel closed the week with a modest uptick to $2.1492 on Friday. Overall, diesel prices increased by $0.0030, or 0.14%.

Gasoline prices opened at $2.0941 on Monday and fluctuated throughout the week. Prices dipped to $2.0784 on Tuesday before rebounding to a weekly high of $2.1048 on Wednesday. After a slight pullback on Thursday, prices rose again on Friday to close at $2.1094. Overall, gasoline prices increased by $0.0153, or 0.73%.